- Kingscrowd Newsletter

- Archive

- Page 1

Archive

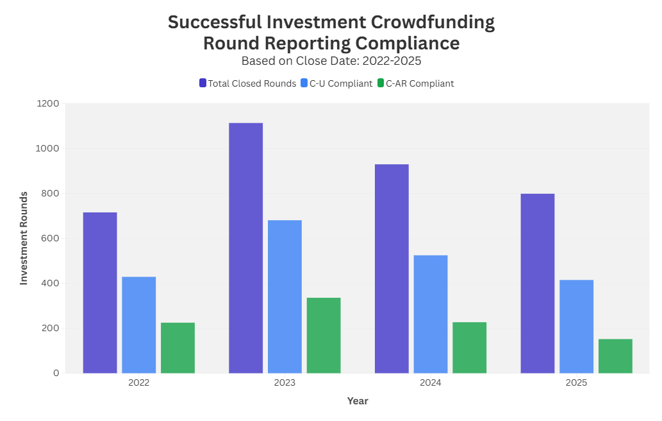

Reg CF Reporting Compliance: Are Companies Closing the Loop After They Close a Round?

When an Investment Crowdfunding round closes, the fundraising story isn’t “done”, it moves into the reporting phase. The SEC requires issuers to file a Final Disclosure (Form C-U) shortly after close and to provide ongoing updates through an Annual Report (Form C-AR) each year until their reporting obligation ends. For investors, these filings are more than paperwork: they’re often the most reliable, standardized way to confirm what a company actually raised, and whether the issuer is still providing regular public updates after you’ve invested.