- Kingscrowd Newsletter

- Posts

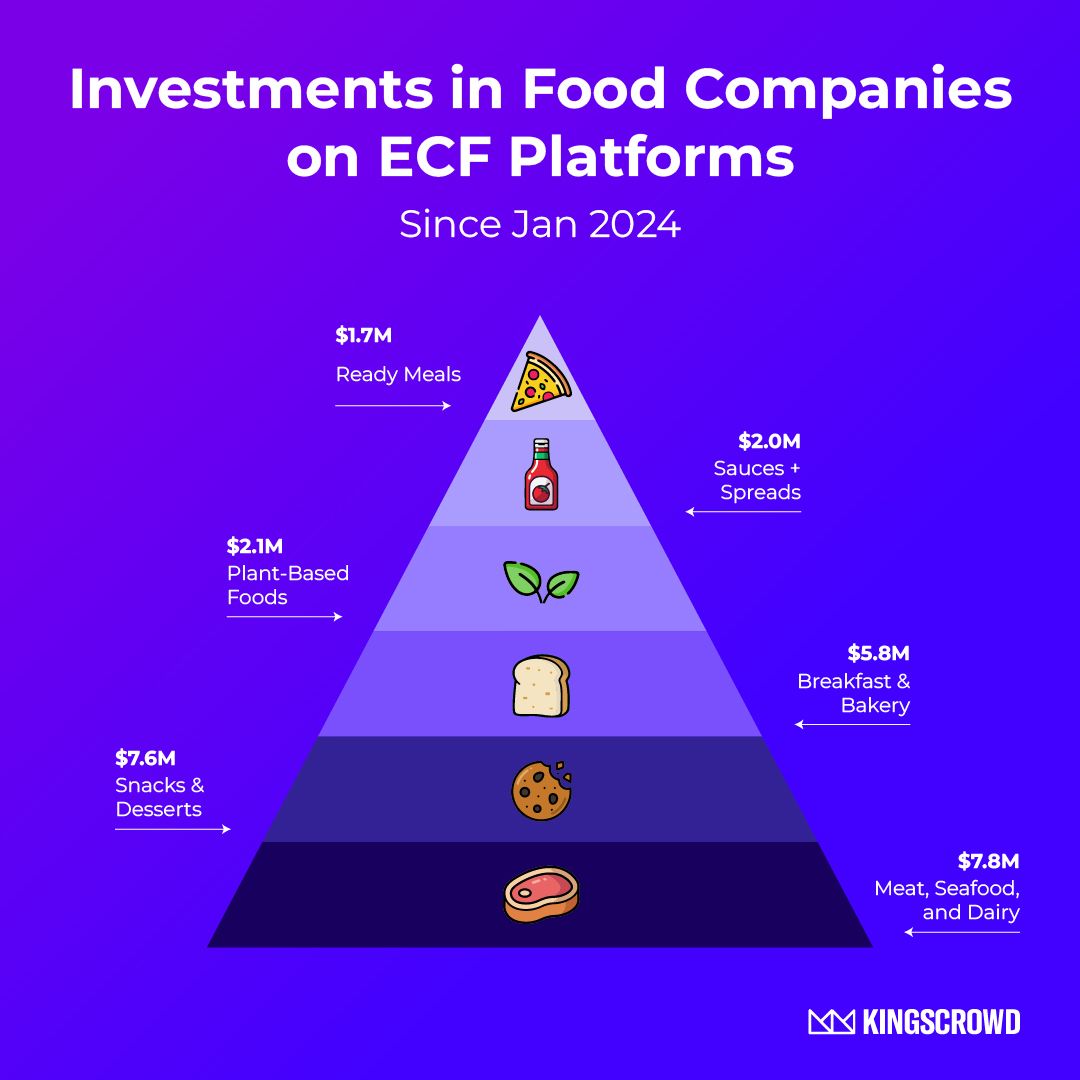

- Food Crowdfunding: Meat and Snacks Eat the Biggest Slice

Food Crowdfunding: Meat and Snacks Eat the Biggest Slice

Kingscrowd analyzed $27M raised across food and beverage crowdfunding. From direct-to-consumer beef boxes to premium snacks, investors are backing transparency and indulgence.

CHART OF THE WEEK

Food startups are cooking up serious investor appetite. Kingscrowd analyzed $27 million in capital raised across equity, debt, and revenue share food deals—and the results are as close as it gets. Meat, Seafood, and Dairy leads with $7.78M raised, narrowly topping Snacks and Desserts at $7.63M.

Direct-to-consumer farming models like Plainview Beef ($2.1M) and Porter Road ($1.1M) are driving investor interest, while functional snack brands like Blender Bombs ($3M+) prove that healthy indulgence sells. Bakery ($5.8M) holds strong in third, powered by local favorites like IZOLA Bakery ($880K) and community loyalty campaigns.

Meanwhile, Plant-Based Foods cooled to $2.1M, and Sauces and Ready Meals rounded out the menu. The takeaway? Investors are hungry for authenticity, transparency, and brands that bring fans to the table.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email.

UPCOMING EVENTS

Demo Day Q4 2025 — Featuring Special Guest Judge David Willbrand

Kingscrowd’s final Demo Day of the year is happening Wednesday, December 10th at 1pm ET. Join us live as founders pitch their startups in rapid-fire format—with expert commentary and Q&A from Pacaso Chief Legal Officer and venture veteran David Willbrand. Don’t miss your chance to discover new deals, hear sharp analysis, and vote for the Best Pitch of Q4.

🗓️ Wednesday, Dec 10th, 1pm ET → Register now 👇

UPCOMING EVENTS

Citizens Coffee Investor Q&A Join Kingscrowd Capital and Citizens Coffee CEO Justin Giuffrida for a candid look at channel strategy, unit economics, and the 2026 growth plan—plus live audience Q&A. Save your seat to attend live or get the replay. |

James Sinclair Founder Workshop Thu, Dec 4 • 3PM ET Join us for a live founder workshop with serial entrepreneur and author James Sinclair, who will share tactical frameworks from Starting a Startup: Build Something People Want to help turn ideas into real traction. Live attendees will be entered to win 1 of 10 copies of his book plus a 1:1 coaching session with James. |

KINGSCROWD PODCAST

Wefunder’s “Top Investors”: Kingscrowd Capital #1 — Plus Macrovey Robotics Deal Review

By Sam Fiske / Watch | Apple | Spotify

We unpack Wefunder’s new rankings (KC Capital lands #1), preview Citizens Coffee (Dec 4, 2pm ET) and Q4 Demo Day (Dec 10, 1pm ET), then dive into Macrovey—a 40-year materials-handling installer evolving into a hardware-agnostic warehouse automation platform (see them pitch at Q4 Demo Day). What the pivot means for margins, RaaS, and investor upside.

PITCH REVIEW 💸

By Teddy Lyons \ Deal Report

Brief: Fragment Media operates a reader-first media ecosystem built on audience-driven revenue, successfully demonstrated through its flagship science publication, Nautilus. Its network reaches over 80 million people monthly, with one million newsletter subscribers and $47 million in cumulative revenue over the past four years. Fragment Media aims to raise up to $1 million to expand audience acquisition and support working capital as it scales its reader-supported model.

Teddy’s Take: Let’s be real: the publishing world is getting hammered, and AI’s got a big fist in the fight. Between Google’s AI Overviews slashing news site traffic by up to 34% and chatbots like ChatGPT summarizing articles so nobody clicks through, the old-school magazine and newsletter game feels like it’s on life support. DotDash Meredith is openly bracing for a “Google Zero” future. DMG Media just reported an 89% drop in referral clicks in a single month, blaming AI summaries that keep users glued to search pages. Even subscription models are wobbling as AI pulls snippets past paywalls, leaving outlets like The Verge to pivot hard into podcasts and social-style feeds just to stay afloat. It’s grim out there, and the fear is that AI could make entire swaths of publishing obsolete, turning magazines and newsletters into relics for nostalgics.

Despite this doom and gloom, Fragment Media Group’s traction can’t be ignored. They’re holding ground in a market that’s chewing up less nimble players. Its flagship science publication, Nautilus, has grown to 20,000+ paying subscribers and 550% YoY expansion, powering the group to $11.5 million in 2024 revenue and $47 million total over the past four years. But it’s not all rosy: its revenue dipped, down 15% year-over-year, and they’ve leaned harder into subscriptions over ads, a pivot to dodge the AI-driven ad revenue cliff that’s tanking others. With 80% margins and a tight niche focus, Fragment’s betting on loyal readers over algorithmic scraps, backed by a team of Gawker and Atlantic vets who’ve been around the block.

At a $14M valuation on Wefunder, Fragment’s raise is one we’re eyeing for Kingscrowd Capital, even if the broader media landscape looks like a warzone. The company’s sub-driven model and high margins suggest they could weather the AI storm better than most, but that revenue dip keeps me cautious.

STAFF PICKS 🌶️

By Teddy Lyons

Artisan Tropic sells plantain and cassava snacks in over 6,000 U.S. stores and generated 9.5 million dollars in revenue in 2024. Its model centers on regenerative agriculture and zero waste manufacturing that strengthen ecosystems and create climate resilient supply chains in Colombia.

By Teddy Lyons

Just Her Rideshare is a women-centric mobility platform that matches female riders and drivers to offer safe, reliable rides. The service reports 26 percent month-over-month revenue growth and more than 10,000 users.

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.