- Kingscrowd Newsletter

- Posts

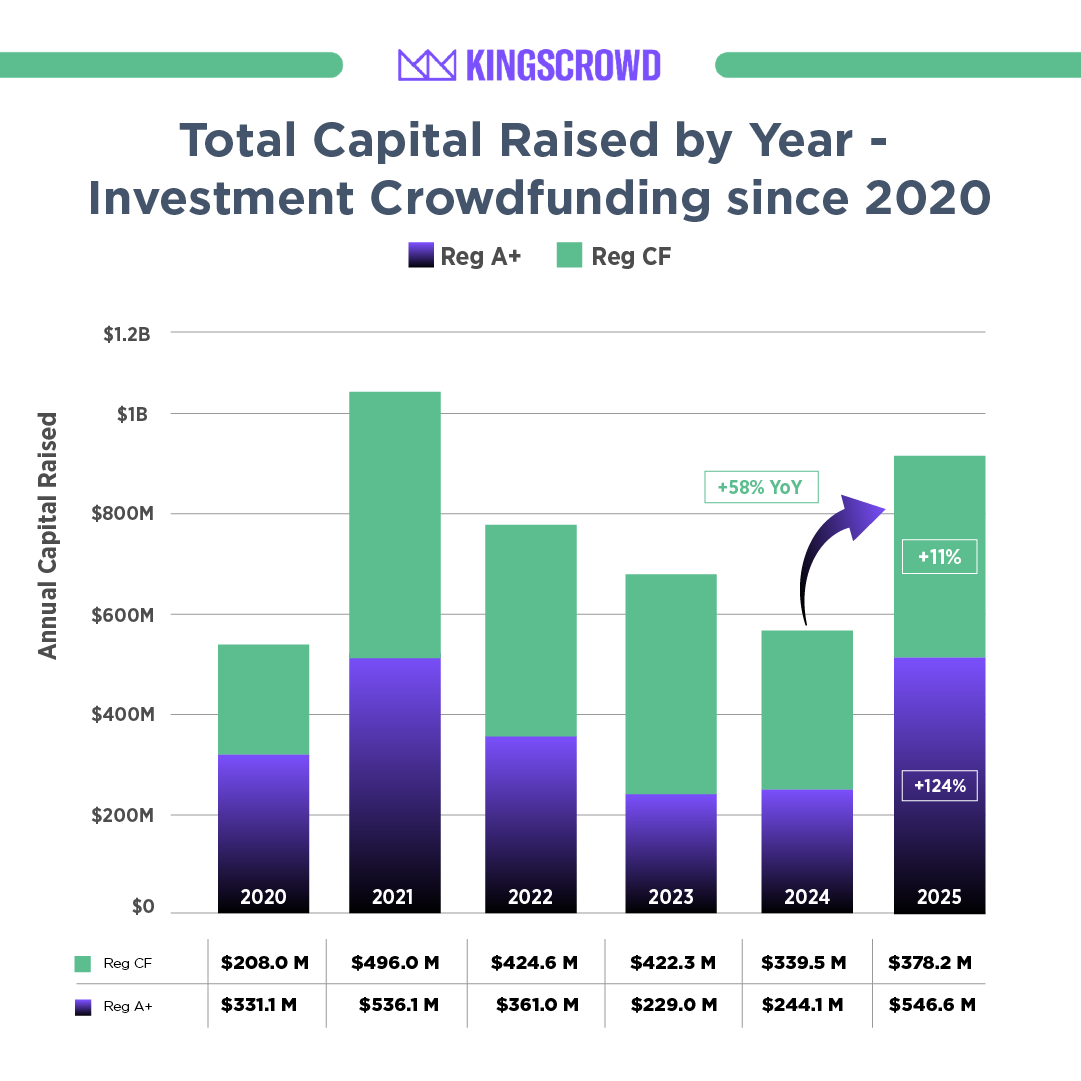

- The 2025 Numbers Are In: $925M Invested Across Reg CF & Reg A+

The 2025 Numbers Are In: $925M Invested Across Reg CF & Reg A+

Investment crowdfunding jumped 58% in 2025 as Reg A+ surged 124% to $546.6M, while Reg CF still grew 11% despite fewer new offerings.

Editor’s Note: Starting this week, the Kingscrowd Newsletter will publish on Tuesdays instead of Mondays. Same data-driven insights—just landing in your inbox one day later.

CHART OF THE WEEK

By Brian Belley | Read

Investment crowdfunding bounced back in 2025, breaking the downtrend since 2021. Total capital raised across Reg CF and Reg A+ jumped 58% YoY, driven by a massive Reg A+ surge to $546.6M (+124%), beating even the 2021 high-water mark, while Reg CF grew to $378.3M (+11%) despite a 29% drop in new offerings. Big Reg A+ rounds kept stacking up (including 8 raises over $40M), while debt and revenue share security offerings continued to fade, down to $38.7M (-10%) and roughly half of the 2023 peak. Read the full 2025 Investment Crowdfunding Annual Report for the complete breakdown, top raises, and what these trends mean for platforms, issuers, and investors.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email.

EVENTS

Invest in private markets with your IRA. StartEngine (with $2.1B invested) and Equity Trust ($75B in assets under custody & administration) have teamed up to help investors explore private-market opportunities using tax-advantaged retirement dollars. Join StartEngine Chief Revenue Officer Josh Amster and Equity Trust’s John Bowens for a step-by-step walkthrough of self-directed IRA setup, transfer/rollover basics, the 50/30/20 allocation framework, and what it means to invest pre-IPO with an IRA.

🗓️ Wednesday, January 28th, 1pm ET → Register now 👇

Join Kingscrowd CEO Chris Lustrino live on Jan 22 at 1pm ET for an investor update covering our $2.69M+ in 2025 booked sales, the CrowdCheck acquisition, and the 2026 roadmap for product and growth. He’ll also share how our current StartEngine funding round supports the next phase—plus live Q&A. |

KINGSCROWD PODCAST

2025 Annual Report | BabyQuip Deal Update

By Sam Fiske / Watch | Apple | Spotify

2025 bounced back for the online private markets: Reg A+ jumped ~124% YoY to ~$547M while Reg CF climbed ~11% to ~$380M—despite ~30% fewer offerings. Brian and Scott unpack the numbers and what the shifting security mix (more preferred, more debt) says about quality. Then Léa returns to review BabyQuip’s latest round—revenue up since FY22, burn down in ’25, partnership-led growth, and a new “GoQuip” category—raising at roughly the same share price as ~2.5 years ago.

PITCH REVIEW 💸

By Léa Bouhelier-Gautreau \ Deal Report

Brief: Solsten is a psychology-driven audience intelligence company that helps businesses understand the motivations and personalities behind customer behavior. Its AI-powered platform combines psychometric assessments with a dataset of over 1.5 million profiles to reveal the emotional drivers that influence how people engage with digital products and marketing. Initially gaining traction in gaming, Solsten has expanded to serve major brands like LEGO, Sony, and Peloton, enabling more empathetic and personalized user experiences.

Léa’s Quick Take: Finding the right ad can make or break a company. In the age of conversational AI, I’d bet that most marketers have tried using tools like ChatGPT or Gemini to come up with advertising ideas, or even generate ads from scratch. How many of those attempts actually worked? Probably not many.

Creating a good ad isn’t just about putting a slogan on a nice image. It requires understanding what truly moves an audience by tapping into their deeper motivations. People remember ads that make them laugh, move them emotionally, or make them feel better about themselves. Advertising is an art.

Solsten is trying to master it. Here’s how:

Through its first product, Solsten Traits, the company built a large psychological dataset from game users. This helped companies like Epic Games and Peloton understand the why behind customer behavior and increase personalization in ways that keep users engaged. Building on this foundation, Solsten is now launching Elaris, a conversational AI designed to understand the motivations of a brand’s audience. With Elaris, marketers can quickly create ads that genuinely resonate with their own users.

Solsten isn’t reinventing the (AI) wheel. Its data and technology act as a layer on top of models like ChatGPT, combining the power of large language models with a proprietary psychological database. The company has generated relatively stable revenues of around $2.5 million annually in recent years, and now aims to reach new heights with the launch of Elaris. It is backed by prominent VCs, some of whom are reinvesting hundreds of thousands of dollars in this round.

Over the past two years, I’ve seen many “AI” startups raise money online without truly moving the needle. Solsten feels different, and its value proposition is worth a closer look..

STAFF PICKS 🌶️

By Teddy Lyons

AllSides provides media bias ratings and side-by-side news comparisons to help people escape filter bubbles and see all viewpoints. The company serves more than half a million users each month and is used in classrooms nationwide.

By Teddy Lyons

Vampire Corporation operates a national lifestyle wine and spirits brand built on powerful trademarks like VAMPIRE and DRACULA, sold in retailers and online. In 2024 the company nearly doubled its direct-to-consumer revenue while maintaining profitability.

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.