- Kingscrowd Newsletter

- Posts

- Reg CF Reporting Compliance: Are Companies Closing the Loop After They Close a Round?

Reg CF Reporting Compliance: Are Companies Closing the Loop After They Close a Round?

When an Investment Crowdfunding round closes, the fundraising story isn’t “done”, it moves into the reporting phase. The SEC requires issuers to file a Final Disclosure (Form C-U) shortly after close and to provide ongoing updates through an Annual Report (Form C-AR) each year until their reporting obligation ends. For investors, these filings are more than paperwork: they’re often the most reliable, standardized way to confirm what a company actually raised, and whether the issuer is still providing regular public updates after you’ve invested.

Editor’s Note: Kingscrowd Pro is here. Offering platforms, agencies, and advisors faster prospecting tools and streamlined client fundraising reporting through Pro Search, the Client Tracker dashboard and more.

CHART OF THE WEEK

By Chris Martin\ Read

Final Disclosures & Annual Reports

In accordance with U.S. Securities and Exchange Commission (SEC) rules governing Regulation Crowdfunding, a company is required to file a Final Disclosure (Form C-U) to report the total amount of securities sold no later than five business days after closing its crowdfunding offering.

Additionally, issuers must file an Annual Report (Form C-AR) within 120 days of the end of their fiscal year for each year in which they have outstanding Regulation Crowdfunding securities.

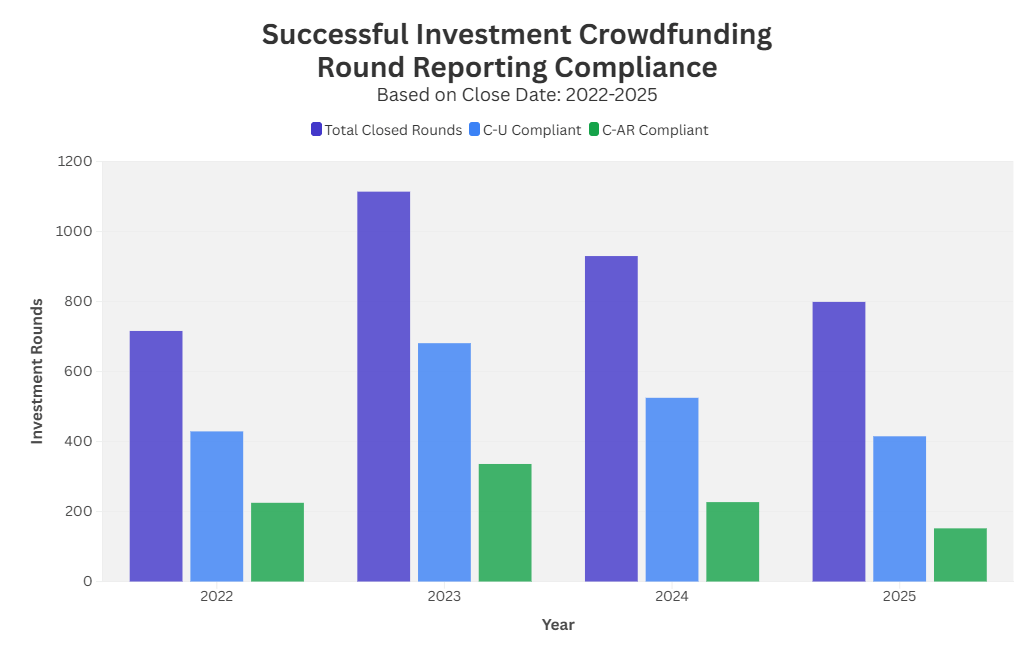

Looking at successful rounds by close year, the data shows a clear drop-off in ongoing reporting over time. While Form C-U compliance has remained relatively steady, with about 60% of closed rounds filing in 2022 (59.9%) and 2023 (61.1%), that rate slips in more recent years to 56.5% in 2024 and 51.9% in 2025. The decline is more pronounced for Form C-AR, falling from 31.4% of closed rounds in 2022 and 30.2% in 2023, to 24.4% in 2024 and just 19.0% in 2025.

Why it matters to investors

For investors, C-AR filings are often the most reliable, standardized way to track a company’s financial condition and operational progress after investing, and companies that fall behind on required annual reporting risk limiting their ability to raise again under Investment Crowdfunding. In practice, these filings act as an important transparency checkpoint, and the data shows that not every issuer reaches it at the same rate.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email.

EVENTS

Invest in private markets with your IRA. StartEngine (with $2.1B invested) and Equity Trust ($75B in assets under custody & administration) have teamed up to help investors explore private-market opportunities using tax-advantaged retirement dollars. Join StartEngine Chief Revenue Officer Josh Amster and Equity Trust’s John Bowens for a step-by-step walkthrough of self-directed IRA setup, transfer/rollover basics, the 50/30/20 allocation framework, and what it means to invest pre-IPO with an IRA.

🗓️ Wednesday, January 28th, 1pm ET → Register now 👇

KINGSCROWD PODCAST

Predicting Private Markets in 2026 | Kingscrowd Pro | AI | SEC

By Sam Fiske / Watch | Apple | Spotify

Kick off 2026 with Brian, Scott, and Teddy as they recap 2025’s online private markets (Reg A+ surge, secondaries heat-up, policy shifts) and lay down bold predictions for 2026—AI-fueled productivity, a B2B SaaS shakeout, and rising opportunities in defense and energy. They also preview Kingscrowd Pro for industry teams and touch on our live raise on StartEngine. Tune in for data-backed insights and what to watch next.

PITCH REVIEW 💸

By Teddy Lyons \ Deal Report

Brief: Carnyx Therapeutics develops novel peptide-based therapeutics focused on sleep and vision health. The company’s lead candidate, CNXY-005, is an Epitalon peptide analog designed to improve sleep with fewer doses by remaining active in the body longer and being orally administered. Carnyx is also advancing a proprietary molecular solution for vision disorders such as retinitis pigmentosa.

Teddy’s Quick Take: I keep a close eye on pharma companies popping up in the equity crowdfunding space, always hunting for those early-stage plays with real science and experienced teams. Carnyx Therapeutics jumped out at me recently. Their approach to anti-aging and longevity through peptides feels like the next wave in biotech, especially with all the buzz around sleep and circadian health these days.

Carnyx is building CNXY-005, an advanced analog of the Epitalon peptide designed to restore your body's natural 24-hour clock, boost deep non-REM sleep, and potentially extend healthy lifespan. Epitalon has shown promise in research for protecting the protective caps on the ends of your chromosomes (called telomeres, which shorten as we age and contribute to aging-related decline), supporting cellular repair, and fighting aging effects. But Carnyx is tweaking it for better bioavailability in pill form. That means it can be absorbed through the gut and stick around longer in the bloodstream. They're also exploring eye-drop versions for vision issues such as retinitis pigmentosa. They're targeting the massive longevity market, where people are spending billions on anything that promises more years in good health.

The company is pre-clinical right now. Founded in mid-2024, they're in the discovery and optimization phase, focusing on proprietary peptide engineering to make these compounds oral or topical instead of injectable. That's a big deal because it opens up consumer-friendly paths like supplements or over-the-counter options down the line, bypassing some regulatory hurdles compared to traditional drugs. No human trials yet, but the science builds on decades of Epitalon studies, and the team's plan is to generate strong pre-clinical data that could attract big pharma partnerships early.

What I really love about Carnyx is the founder's track record. Co-founder and CEO Dr. Patrick Gunning has two solid exits under his belt: Janpix, a biotech he built that got acquired in the pre-clinical stage, and Dunad, which landed a major partnership deal with Novartis worth $1.3B. That kind of experience in drug discovery and deal-making is gold in early pharma, especially at this stage where de-risking through partnerships or acquisitions is common. Carnyx is obviously super early, so no revenue yet, but that's why the upside feels huge if they hit milestones like proof-of-concept data or a pharma deal.

If you're into biotech with massive potential in the exploding longevity sector and a founder with a strong track record in pharma, Carnyx is worth checking out on Equifund.

STAFF PICKS 🌶️

By Teddy Lyons

ExactRx turns manual pre-op and administrative tasks into intelligent, autonomous processes that ensure documentation is complete and compliant for surgery centers. By embedding real-time rule validation into clinical workflows, it helps reduce delays, denials, and operational waste that burden facilities today.

By Léa Bouhelier-Gautreau

STEPR is trying to replicate Peloton’s success with a stair-climbing machine. Revenues show early traction: STEPR generated $13.6 million in 2024, an 82.7% increase year over year. However, without a pandemic and in an inflationary environment, the key question is how much further STEPR can grow, especially given its already $60 million valuation.

By Teddy Lyons

Heart Failure Solutions is developing a minimally invasive device to treat heart failure with preserved ejection fraction, a condition with few effective therapies. Its PeriCut System is already in FDA approved early feasibility studies.

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.