- Kingscrowd Newsletter

- Posts

- What’s a Fair Valuation? Startups by Revenue Tier

What’s a Fair Valuation? Startups by Revenue Tier

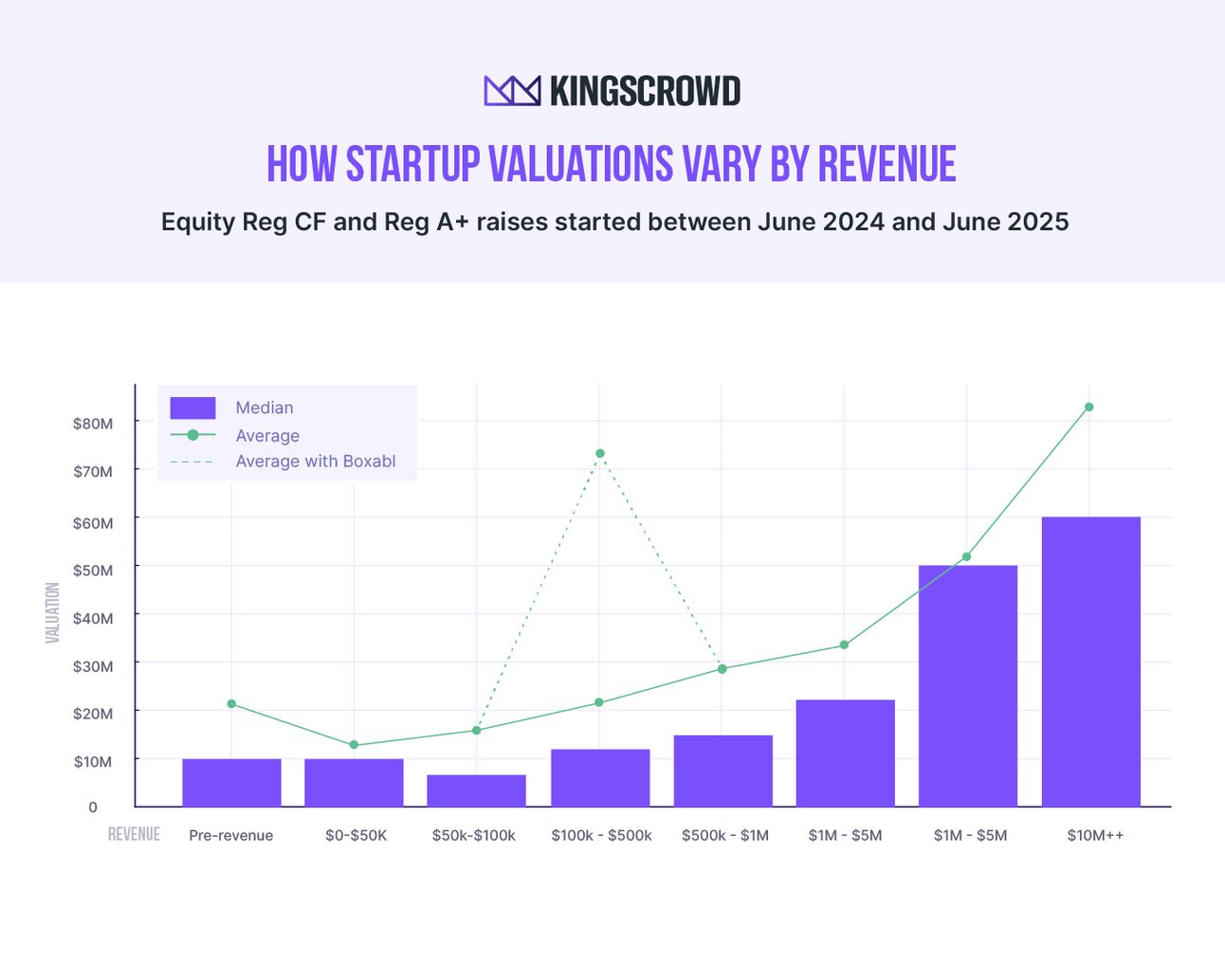

Kingscrowd analyzed startup valuations by revenue bracket in equity crowdfunding raises. Learn how pre-revenue startups compare to $10M+ revenue companies—and how to spot valuation outliers.

CHART OF THE WEEK 📈

By Léa Bouhelier-Gautreau | Read

In this week’s Chart of the Week, we explore how startup valuations vary by revenue level across the equity crowdfunding space. Our new analysis shows that valuations generally rise with revenue—but that pre-revenue startups often command surprisingly high price tags, especially in deep tech and healthcare. We also highlight valuation outliers like Boxabl and explain how these can skew investor expectations. If you're wondering what counts as a “reasonable” valuation in online raises, this chart is for you.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email

KINGSCROWD PODCAST

This week on the Kingscrowd Podcast, we discuss hidden investor risks in crowdfunding IPOs and acquisitions, and explore surprising data on how startup valuations align—or don't—with revenue.

UPCOMING EVENTS

Join us for an exclusive webinar featuring Zeus Companies, a vertically integrated real estate investment and development firm democratizing access to high-yield private real estate deals. Learn how investors are tapping into Zeus’s multifamily and mixed-use projects—and why their model stands out in today’s market.

| Sign up now to hear Doc2Doc Lending CEO, Dr. Zwade Marshall, join Chris Lustrino and the Kingscrowd analyst team on July 1 (3 pm ET / 12 pm PT) for our first Kingscrowd Capital Investor Event and get an inside look at this physician-focused fintech’s traction and growth plans. |

| Kingscrowd Summer Demo Day When: Tuesday, July 15th at 1pm ET Hear live pitches from standout startup founders, ask questions in real time, and gain investment insights from the Kingscrowd team—all in one high-energy, interactive session. |

| ICYMI: Investing in Energy Infrastructure |

PITCH REVIEW 💸

By Teddy Lyons \ Deal Report

Brief: Foment Bio is a biopharmaceutical company developing a novel transient gene therapy platform to treat cardiometabolic dysfunction. Its therapy stimulates regenerative exosome production, helping prevent cell death, reduce fibrosis and inflammation, and restore microvasculature. While the platform holds strong promise for human use, Foment Bio is initially targeting the companion animal market to accelerate commercialization.

Teddy’s Take: If you’ve been following our Kingscrowd Capital investments, you know that I am all about gene-therapy startups these days. We recently invested in Siren Biotechnology, one of the top biotech startups I’ve seen raise in the equity crowdfunding space.

Today, I’d like to introduce you to another gene-therapy startup, Foment Bio. While Siren Biotech is using viral gene therapy to treat cancer, Foment Bio is using non-viral gene-therapy to treat heart conditions. What does this mean exactly? Well, with AAV-gene therapy (like Siren), viruses are used to “deliver” payloads to a specific area of the body that are generally used to fix missing/mutated genes (or in Siren’s case, to deliver cancer treating payloads).

Foment has developed a different type of gene therapy that doesn’t use viruses. Instead, it sends temporary genetic instructions into the body that tell cells to make exosomes—tiny particles that help heal tissue. These exosomes naturally trigger the body to repair itself by reducing inflammation, preventing cells from dying, fixing damaged blood vessels, and improving how organs work. The kicker? Foment Bio is planning to distribute its drug to the companion animal market first in order to commercialize its technology quicker (within next 2-3 years).

Now, there is a big distinction between Foment Bio’s lead drug candidate, FB-101 (which has been through multiple Phase 2 human studies), and its new drug candidate, FB-201. But I don’t have enough space, so dive into the full report.

STAFF PICKS 🌶️

By Teddy Lyons

Ever since the WeWork debacle, I tend to cringe at co-working space startups. But MCS, with its focus on providing space for healthcare providers, may actually have found the perfect use-case for this business model.

By Léa Bouhelier-Gautreau

Getting a good return on an equity investment in an apparel brand is tough. It's a crowded, competitive space where true product differentiation is rare, and marketing is expensive. Surprisingly, Wild Rye plays in a relatively underserved niche, has strong institutional backing, and shows solid revenue growth. In a market where acquisitions often hit hundreds of millions, it's worth a look.

By Léa Bouhelier-Gautreau

I believe drone technologies have a bright future. From package delivery to military use, the potential is huge. One of the last hurdles is making drones more seamless, such as enabling smoother recovery. Target Arm is solving that problem, with support from the DoD and institutional investors.

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.