- Kingscrowd Newsletter

- Posts

- June Wrap-Up: Crowdfunding Cools as Q3 Begins

June Wrap-Up: Crowdfunding Cools as Q3 Begins

The summer cooldown has arrived—June saw lower totals but familiar leaders like StartEngine and Wefunder held firm.

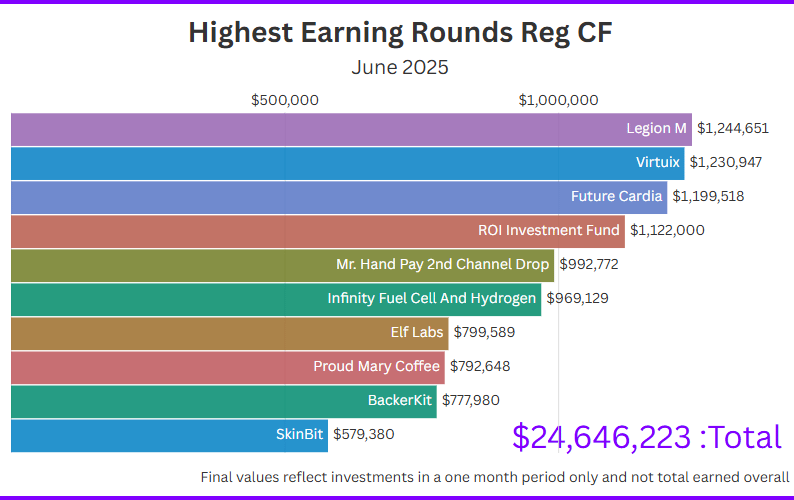

CHART OF THE WEEK 📈

By Chris Martin | Read

After a red-hot spring, June cooled things down, but not without a few surprises. A familiar trio led the fundraising charts, a creator-driven campaign returned with serious traction, and a niche platform quietly broke into the top ranks. Plus, the industry said goodbye as a funding portal that quietly closed its doors.

📰 See who topped the charts, who came back strong, and what it all means for summer funding trends.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email

KINGSCROWD PODCAST

On the Kingscrowd Podcast this week, we dive into the world of tokenized equities. With Robinhood, Coinbase, and Republic pushing forward, learn what Mirror Tokens mean for investing in late-stage private companies—and what risks you need to know.

UPCOMING EVENTS

Join us for an exclusive webinar featuring Zeus Companies, a vertically integrated real estate investment and development firm democratizing access to high-yield private real estate deals. Learn how investors are tapping into Zeus’s multifamily and mixed-use projects—and why their model stands out in today’s market.

| Kingscrowd Summer Demo Day When: Tuesday, July 15th at 1pm ET Next week - hear live pitches from standout startup founders, ask questions in real time, and gain investment insights from the Kingscrowd team—all in one high-energy, interactive session. |

| ICYMI: Investing in Energy Infrastructure |

PITCH REVIEW 💸

By Léa Bouhelier-Gautreau \ Deal Report

Brief: GigaStar is a fintech platform that enables YouTube creators to raise capital by selling a share of future ad revenue through Channel Revenue Tokens, giving fans and investors a stake in creators’ success. This solves a key challenge in the creator economy—accessing growth capital without giving up equity or creative control.

Léa’s Take: These days, you can invest in almost anything,stocks, sneakers, even songs. GigaStar stands out by offering something truly unique: the chance to back YouTubers and earn a share of their revenue every month. The model is simple and striking, invest in a creator, and start getting paid as their content generates income. It's rare to see something genuinely disruptive in the online investment space, but GigaStar is opening the door to a brand-new asset class.

Early traction looks strong. The company has raised 9.8 million dollars, with support from Belvedere Strategic Capital, DV Crypto VC, and Nameless Ventures, serious names that matter in a capital-intensive two-sided marketplace. On the creator side, 23 YouTubers have already raised a combined 4.3 million dollars through the platform. If current growth continues and the platform keeps its run rate, GigaStar could double its 2024 revenue and reach the $1 million dollar milestone, just as management expects.

Still, the opportunity comes with real risk. GigaStar is tackling multiple challenges at once: building a two-sided marketplace from the ground up, introducing a new and unfamiliar investment vehicle to the public, and navigating a complex and fast-evolving regulatory landscape. Two-sided marketplaces are notoriously difficult to scale, requiring both strong creator adoption and sustained investor interest. It remains uncertain whether a large enough pool of investors will embrace the idea of backing YouTubers to allow GigaStar to scale into a truly sustainable business. If the team succeeds, early backers could benefit meaningfully from a first-mover advantage. But at a high valuation of $58 million, investors have to ask: is the potential reward high enough to justify the substantial risk?

STAFF PICKS 🌶️

By Teddy Lyons

EndoSound has commercialized its Endoscopic Ultrasound (EUS) device for GI disease detection that is 12X cheaper than the current standard of care. With FDA-clearance and a $5M licensing deal inked, is this a no brainer investment?

By Léa Bouhelier-Gautreau

I believe technology should give us more time back, and take worries off our plate. That’s exactly what Option Circle is aiming to do with trading. Its AI can automate stock market investing, helping users trade without stress. Of course, the big question is always the same: is this actually solving a real pain point, or is it just another gimmick? Well, so far, the results speak for themselves. Option Circle grew its revenue by 130% between 2023 and 2024, hitting the $500K mark with just 200 paying subscribers. That kind of traction suggests users are not just curious, they’re sticking around.

By Teddy Lyons

RegenMed is raising again after a 3X+ revenue increase since its last 2024 raise. While impressive, I’m still not convinced the company near product-market fit with its data-subscription model for physicians. What would change my mind?

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.