- Kingscrowd Newsletter

- Posts

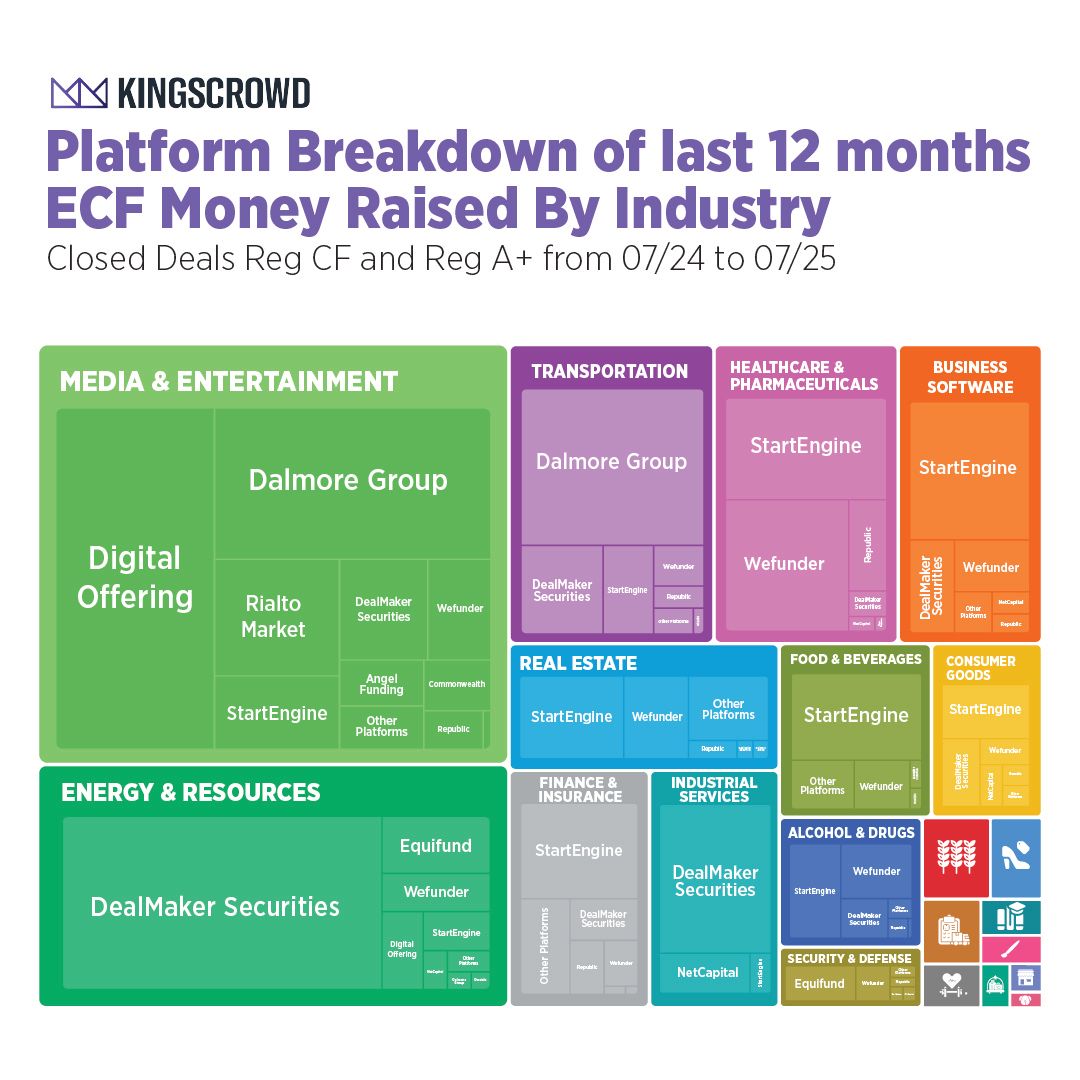

- Investors Poured $683M into Startups—Here’s Where It Went

Investors Poured $683M into Startups—Here’s Where It Went

Explore our data on where capital was actually deployed this past year.

CHART OF THE WEEK 📈

By Léa Bouhelier-Gautreau | Read

Where Did $683M Go in Crowdfunding This Year?

In this week’s Chart of the Week, we shift from supply to demand—tracking the $683.8 million raised from closed Reg CF and Reg A+ deals over the past 12 months. The data reveals that Media & Entertainment, Energy, Transportation, and Healthcare led the way. Platforms with broker-dealer infrastructure dominated the top 10 raises, and Reg A+ deals accounted for half of all dollars raised. If capital reflects conviction, this year’s funding patterns tell us what investors truly believe in—and where they see the most potential.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email

KINGSCROWD PODCAST

Substack hits unicorn status—what’s next for Wefunder investors? Plus, Kingscrowd’s mid-year crowdfunding trends show Reg A+ is surging again.

WEBINARS THIS WEEK

This Wednesday, July 30th at 1:30pm ET, please join us for exclusive, live access to CEO Dr. Nicole Paulk as she explains how Siren’s “universal” AAV immuno-gene therapy turns tumors into their own treatment factories—one reason our analyst team rated the company a Kingscrowd Top Deal. Bring your questions to this one hour fireside chat by Kingscrowd Capital as we explore potential investment opportunities.

Partnerships 101 and Growing you Investor Network When: Tuesday, July 29th at 3pm ET Calling all founders - Level-up your growth strategy in one hour: discover how to launch scalable partnerships and attract accredited angels to your Reg CF round in Kingscrowd’s free webinar with Branchworks and Meet Capital. |

ICYMI: Learn About Steady Returns with Short-Term Deb in Real Estate |

PITCH REVIEW 💸

By Léa Bouhelier-Gautreau \ Deal Report

Brief: Future Cardia is raising to advance its implantable heart failure monitoring device. The small sensor uses AI and remote tech to capture continuous cardiac data, helping physicians manage heart failure more effectively. Selected by Johnson & Johnson Innovation, Future Cardia has implanted its device in 39 patients and recorded over 60,000 hours of heart data.

Léa’s Take: Future Cardia continues to raise capital online after its recent $2.7 million success on StartEngine. It’s been genuinely exciting to watch this company grow since its first online raise back in 2020. For a medtech startup, Future Cardia has moved at a solid pace, hitting milestone after milestone with only the kind of delays you’d expect in this space. That steady execution is what brought Kingscrowd Capital in as an investor a year ago.

The company has now successfully implanted its device in 39 patients as part of its human trials in a capital-efficient way, conducting the implants in Eastern Europe to move quickly without burning through funding. That’s impressive compared to how long it usually takes other insertable device startups to get even a few implants done.

Here’s where things get interesting for those of us who’ve been following the company for the past five years. Future Cardia is now finalizing MRI safety, cybersecurity, and EMI/EMC testing, and remains on track to submit to the FDA by November 2025 via the 510(k) pathway, which is one of the faster routes. Founder and CEO Jaeson Bang has a strong network in cardiology and the medtech industry, and he plans to leverage those relationships to launch commercialization right after approval.

Of course, investing in a company like this comes with real risks. FDA clearance is still ahead, and entering a market where most cardiologists rely on devices from legacy players won’t be easy. But that’s part of the appeal—this is the kind of high-risk, high-reward bet that, if it works, becomes one of those smart startup picks we get to brag about later.

STAFF PICKS 🌶️

By Léa Bouhelier-Gautreau

Our Bond, the service that offers peace of mind, is back with another raise after Kingscrowd Capital invested in its latest round. This capital-intensive startup is trying to redefine the private security category by getting large corporations to offer the service to their employees. Our Bond clearly needs to reach high sales volumes to turn a profit. But if it manages to do so, it will surely be rewarding for investors.

By Léa Bouhelier-Gautreau

One of the major issues in electric vehicles (EV) adoption is the lack of charging infrastructure, at home, at work, and in public spaces. Power Hero is trying to solve this problem by developing a portable EV charging solution. However, Power Hero has been promising its first product release back in 2023, and has now pushed its first market entrance to the end of 2025. What's the hold-up?

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.