- Kingscrowd Newsletter

- Posts

- From Turf to Tokens: Why Fractional Thoroughbreds Are Becoming 2025’s Purest Power‐Law Play

From Turf to Tokens: Why Fractional Thoroughbreds Are Becoming 2025’s Purest Power‐Law Play

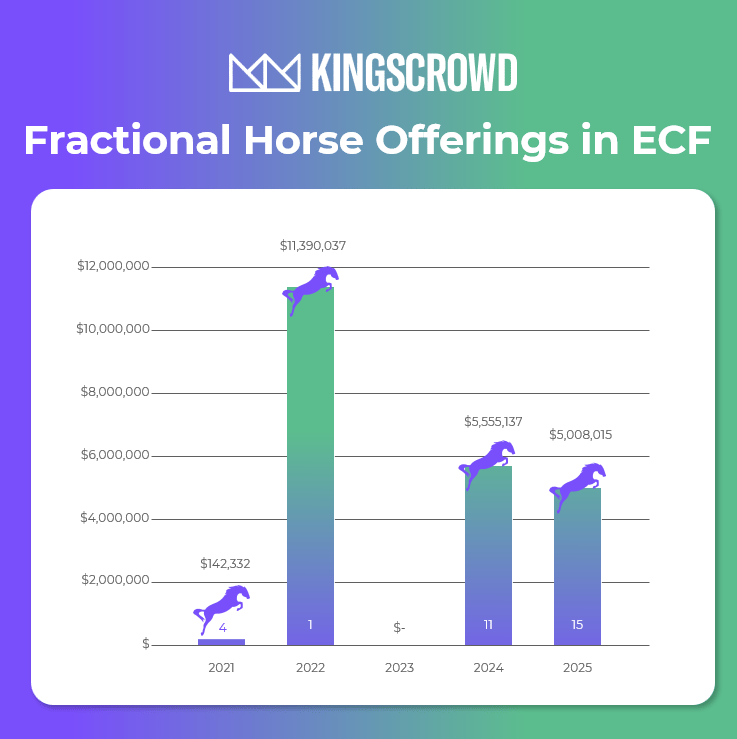

This Chart of the Week unpacks the fees, risks, and wild ride behind MyRacehorse and other equine investment offerings.

CHART OF THE WEEK 📈

By Teddy Lyons | Read

In this week’s Chart of the Week, Teddy dives into the surging popularity of fractional racehorse investing, where retail investors can back racehorses through platforms like MyRacehorse. With over $5M raised in the first half of 2025 alone, the market is growing—but beneath the surface lies a complex fee structure and unpredictable outcomes. This is not your average startup investment. He breaks down how the model works, what investors actually own, and why this sector may be the purest high-risk, high-reward bet on the internet.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email

INSIDE STARTUP INVESTING

Kingscrowd Podcast will be back next week

In this week’s Inside Startup Investing episode, Chris Lustrino speaks with Ryan Duey, co-founder and co-CEO of Plunge, the cold plunge and sauna company generating more than $80 million in annual revenue.

Duey shares how the company grew from a garage project during COVID to a leading DTC wellness brand — with minimal outside capital. He also breaks down their manufacturing and logistics strategy, lessons learned scaling physical product operations, and how Plunge is expanding into adjacent product categories.

UPCOMING EVENTS

Next Thursday, July 24th at 1pm ET - please join us for an exclusive webinar featuring Zeus Companies, a vertically integrated real estate investment and development firm democratizing access to high-yield private real estate deals. Learn how investors are tapping into Zeus’s multifamily and mixed-use projects—and why their model stands out in today’s market.

| Kingscrowd Summer Demo Day When: Tuesday, July 15th at 1pm ET TOMORROW- hear live pitches from standout startup founders, ask questions in real time, and gain investment insights from the Kingscrowd team—all in one high-energy, interactive session. |

| Kingscrowd Capital Investor Event: RISE Robotics When: Wednesday, July 23rd at 1pm ET Join us for a live fireside chat, CEO Hiten Sonpal will detail how Beltdraulic™ electric actuators replace power-hungry hydraulics in heavy equipment—then field investors’ questions on market adoption, cost savings, and scale-up plans. |

| ICYMI: Investing in Energy Infrastructure |

PITCH REVIEW 💸

By Léa Bouhelier-Gautreau \ Deal Report

Brief: Alpha-Otto is a clean power company reimagining the internal combustion engine for a sustainable future. Its REV Force™ platform is a high-efficiency, fuel-flexible two-stroke engine that runs on fuels ranging from gasoline and diesel to hydrogen and ammonia, delivering over 50% thermal efficiency. Targeted at industries where full electrification isn't yet practical, Alpha-Otto aims to replace traditional engines in generators, heavy-duty vehicles, and microgrids. Its technology addresses the global problem of inefficient, polluting engines by offering a drop-in solution that cuts emissions without compromising performance.

Léa’s Take: When I think about a daunting task, I remind myself of this proverb: The only way to eat an elephant is one bite at a time. Decarbonizing the energy market is just like that. It’s already started, but it’s going to take time, investment, and innovation.

Alpha-Otto isn’t waiting around for the market to adopt hydrogen engines (which could take who knows how long). Clean hydrogen is too expensive now and only makes sense for heavy machinery from an energy density perspective. That's why instead, Alpha-Otto built a product that reduces emissions today and will be ready when clean fuels like green hydrogen become mainstream.

The company built an internal combustion engine that’s more efficient than other fossil fuel engines—so it can already make a difference on both emissions and customer wallets. It can also run on clean fuels like hydrogen or ammonia. So if a customer wants to go green now, they can. If they want to wait for hydrogen prices to drop, they use fossil fuels all while polluting less. And that matters, because the only way to decarbonize heavy vehicles—from big machinery to planes—is to have highly efficient fuel engines.

The product makes sense to me, and I believe there’s a real shot at product-market fit.

But here’s where I get stuck: the go-to-market strategy. That might be the hiccup. I don’t get why the company chose to launch a generator as its first product. If it runs on gasoline, it’s still polluting and just another gasoline generator. Its small size isn’t a big advantage either—many users could just use a battery, which would be cheaper and cleaner. And hydrogen doesn’t really make sense for that kind of use—it’s expensive and inefficient.

I like Alpha-Otto’s product, and the raise is reasonably priced. But right now, I think the company has a better shot at growing by licensing its tech for products that can’t run on batteries—rather than trying to sell a power generator.

STAFF PICKS 🌶️

By Léa Bouhelier-Gautreau

The electric bike market has cooled off following its pandemic-era boom. As the industry contracts, it becomes harder for smaller players to survive—while the largest and most established brands are better positioned to weather the storm. Electric Bike Company could be large enough to weather the storm.

Although the company’s revenues have plateaued, it still generates around $10 million annually. If you believe the e-bike market will rebound, this could be your opportunity to invest in a proven brand at a fair valuation. Just make sure it has what it takes to scale in an increasingly competitive landscape.

By Léa Bouhelier-Gautreau

I've looked at at least 150 drink companies raising online, if not way more, and I always see the same ideas: 50 shades of alcohol and functional drinks, sometimes both in the same can. So when I see something different, I need to let you know. Nutcase Milk is the first chocolate milk I've seen raising online, and surprisingly enough, it does seem like a good business idea: the company makes our childhood's favorite drink healthier and gives it an adult branding. That's worth taking a look at this deal!

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.