- Kingscrowd Newsletter

- Posts

- From Indie to Blockbuster: Film Crowdfunding Dollars Up Nearly 9x Since 2019

From Indie to Blockbuster: Film Crowdfunding Dollars Up Nearly 9x Since 2019

Film crowdfunding has scaled up by roughly 9x from 2019-2025. Kingscrowd charts its success (and failure) while highlighting big-screen names

CHART OF THE WEEK 📈

By Chris Martin | Read

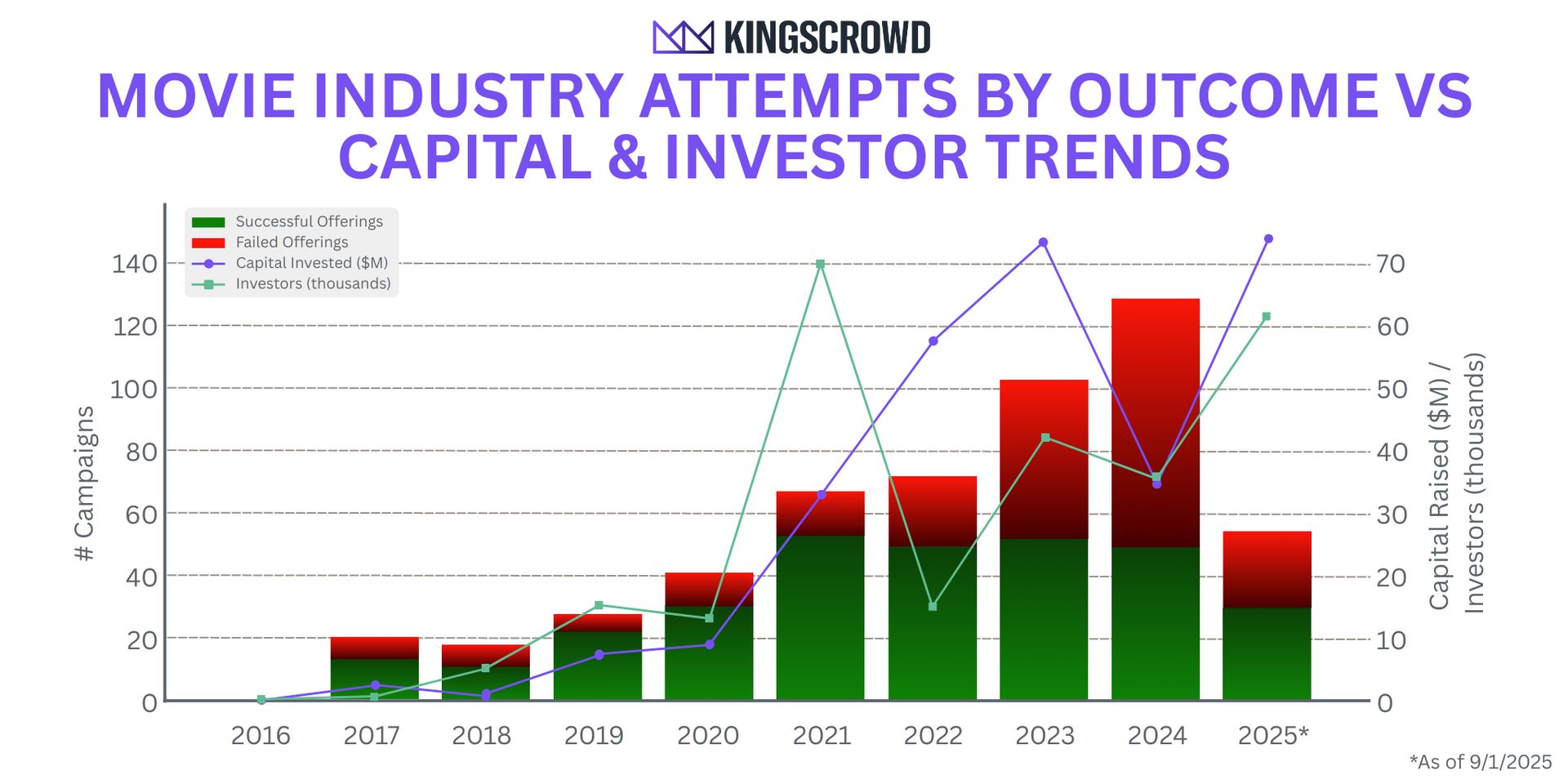

The past few years have reshaped movie financing in the crowd markets. In 2019, our dataset shows 21 qualifying film raises totaling about $7.36 million from roughly 15,100 investors. By 2025 year-to-date, activity and scale had accelerated dramatically: 29 successful raises (out of 63 total attempts) collected about $75.9 million from ~63,200 investors. That’s ~9× the 2019 dollars on a base that grew only ~4× in headcount—a clear signal that bigger checks and larger-format campaigns have entered the mix.

Have a suggestion for a data story you’d like us to look into? Submit by replying to this email.

KINGSCROWD PODCAST

This week on the Kingscrowd podcast

🎟️ Investment Crowdfunding Week is live Sept 29–Oct 2

Panels, pitches (40+ companies), and unfiltered playbooks for founders and retail investors—covering Reg A, mini-IPOs, tokenized securities, and late-stage access.

🎬 Deal Spotlight: Watrfall (Ron Perlman)

A fan-driven film platform raising on Republic. We break down how entertainment deals pay out, what to diligence (rights, distribution, team), and how it fits the broader creator & sports investing trend.

Listen for practical takeaways and mark your calendar for ICW 2025.

UPCOMING EVENTS

Registration is officially open for Kingscrowd’s Investment Crowdfunding Week, happening September 29 – October 2. This four-day virtual event brings together founders, investors, and platforms for the most comprehensive look at the private markets today. With 40+ startups pitching live, fireside chats with industry leaders, and exclusive knowledge sessions, you’ll get insider access to both sides of the crowdfunding equation—how founders raise and how investors evaluate.

Built around the theme “The Full Spectrum,” Investment Crowdfunding Week delivers everything from deal flow intelligence and platform differentiation to founder strategies and market trends. Whether you’re investing, fundraising, or simply exploring the future of alternative assets, this is your chance to connect with the full ecosystem. Reserve your spot today and join us for the premier virtual event in investment crowdfunding.

Kingscrowd Capital Event: EndoSound |

PITCH REVIEW 💸

By Léa Bouhelier-Gautreau \ Deal Report

Brief: Windlift develops autonomous tethered drones that act as airborne wind turbines to generate clean power at high altitudes where winds are stronger. Its system combines renewable energy production with real-time sensing and communication, serving defense and remote applications by reducing reliance on costly, risky fuel convoys and diesel generators. The portable platform can be rapidly deployed, providing both electricity and situational awareness in environments where traditional wind turbines are impractical. Having demonstrated its technology with the U.S. Marine Corps and Naval Research Lab, Windlift positions itself at the intersection of clean energy and national security.

Léa’s Take: Windlift isn’t just chasing the wind, it’s harnessing it to build smarter eyes in the sky. The company positions itself less as an energy play and more as a surveillance innovator, using high-altitude, wind-resilient drones that outperform conventional systems. With roughly $24 million in revenue to date, largely from U.S. military development contracts, Windlift has already demonstrated its ability to ride the gusts of government funding. But those same contracts are irregular, leaving long lulls between projects that have recently forced the company to trim costs and tighten overhead.

Where Windlift truly stands out is in its two flagship systems:

The Guard System is a tethered surveillance drone that climbs up to 800 feet, carrying cameras, radars, or other sensors. Unlike competitors, it doesn’t guzzle power to stay aloft; instead, it thrives in high winds. Tested at 56 mph, where rivals like Hoverfly topple at 20 mph, the Guard remains stable, thanks to Windlift’s proprietary flight control tech. In essence, this drone “loves wind,” gliding with minimal energy input. Its use cases stretch from defense monitoring to protecting commercial shipping routes through chokepoints like the Red Sea and Suez Canal. The first sales could arrive as early as late 2026.

The Airborne Power Generator (APG) takes the idea further, doubling as a flying power plant. By tracing figure-eight patterns in the air, it generates 3–75 kW of electricity while performing surveillance. Proven in simulations and validated by small-scale prototypes under Department of Defense contracts, the APG could unlock scalable applications for military bases, offshore buoys, and even remote farms.

At this stage, Windlift’s $35 million valuation is tied to the success of its prototypes and the achievement of product-market fit. The tech is innovative and highly differentiated, but the stop-and-go nature of government contracts introduces turbulence. If the company can expand beyond defense, secure recurring revenue, and capture niches in commercial surveillance or distributed energy, the upside could be substantial. Windlift’s bet isn’t just on riding the winds — it’s on turning them into a sustainable business model.

STAFF PICKS 🌶️

By Teddy Lyons

Gameflip grew revenue 62% to $4.2M since its raise last year and was profitable in the first half of 2025 The digital gaming marketplace has strong margins (72%) and over a year of runway. So, why are they raising again?

By Léa Bouhelier-Gautreau

YouSolar is raising for the 4th time online. Repeat raises are an amazing opportunity for investors: they can see for themselves the execution pace of a startup and its ability to fulfill promises. In YouSolar's case, numbers are deceiving as the company's revenue decreased by 60% year over year, but its valuation still increased by 82%. The hope? YouSolar claims that sales are finally picking up and that it could generate $5 million in revenue within the next 12 months.

By Teddy Lyons

Backed by Randi Zuckerberg, Citizens Coffee is raising its fourth equity crowdfunding round at 6.5X 2024 revenues. The Australian breakfast chain plans to open six new cafes by the end of 2025. Does Citizens have enough capital to hit this expansion target?

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.